This is certainly not the first time this subject has been internationally broached, but it’s the first time that I’ve seen it build traction in the world.The Hegemony of the U.S. Dollar. There is little doubt that the days of the U.S. Dollar’s exclusive predominance are finite. Given the decisions made in the past, I see no way that the dollar’s monopoly will continue indefinitely.

For starters, the dollar became the world’s reserve currency as a result of the Bretton-Woods agreement in July of 1944. Yes, the international monetary system was negotiated while the Second World War was still being fought. Indeed, the U.S. was in an excellent position to expect agreement with their proposal, as it had just opened up the second front to the German Army in Normandy the month before. The result was an agreement that among other points, established the U.S. Dollar as the world reserve currency and that countries would strive to avoid competitive monetary behavior using the International Monetary Fund. U.N. aid to countries would be funneled though the establishment of what would later be called The World Bank Group.

This made a certain amount of sense at the time. The European economies as well as Europe itself were largely devastated after five years of war, as was Japan and many other parts of Asia. China was still an anarchic nation controlled by oligarchs (to be replaced in 1949 by the world’s largest Communist country ). At that time, hardly anyone saw the Earth’s most populous country as anything but a benign, so-called “sleeping giant.” India was still largely appraised (with paternalistically racist eyes) as “needing” England’s dominance for success. Few other countries’ economies were considered important at that time.

Meanwhile, the U.S. had modern, active, unscathed industry, practically no war-related devastation, and comparatively few war casualities. Even to my jaded, hindsight-enabled mind, it must have made sense for the dollar to become the world reserve currency at that time. Frankly, what was the rest of the world going to do, as an alternative? Say no to the only country that could help them rebuild after the worst war in history?

In 2023, the world economy is different. Western economies still largely dominate the world economically , but there are many new players in the game. China is now an “awake and highly competitive” giant (more about that later). India is on its economic heals, Japan and South Korea are important economic players, OPEC+ now exists, cryto-currencies exist, drug and cybercrime cartels’ power surpasses that of many countries and thanks to digital technology, everything happens in a fraction of the time it took back in 1944.

Second, the Bretton Woods agreement required that the U.S. dollar remain pegged to the value of gold. Presumably, this was intended so that neither the dollar, nor other currencies would lose value. Despite Bretton Woods, the U.S. moved off of the gold standard in 1971, and world currencies moved to flexible exchange rates in 1973 The result, much to the chagrin of Rand Paul and other libertarians was that the dollar predictably lost value, along with most other currencies. If nothing else, this development created an opportunity for any financial safe harbor that could maintain its value better than the dollar.

Third, and by no means the least important, is that the world tacitly agreed that China would become the world’s top sweatshop. With its overwhelmingly large population, its unapologetically authoritarian government, and an international economy eager to reap the benefits of “globalization,” China was in a unique opportunity to become the economic giant international economists murmured about for decades.

The result is that a buyer of Chinese goods in Mexico, for example, has to use Pesos to purchase Dollars, Dollars to purchase Yuan, and Yuan to purchase their goods. This is a tedious process that means that U.S. policy can (and often does) have an influence on practically any international transaction. This is enormously frustrating to any purchaser who is on the wrong end of U.S. sanctions, or any other American policy that inhibits access to dollars. In any event, once we all agreed that China would exploit its labor force to obtain the lowest possible international prices, any reasonable observer would inevitably ask, “can’t this process be simplified?” For now, I will ignore the attendant irony of the world’s largest communist country exploiting its labor class for the benefit of the Chinese nomenklatura and/or international plutocrats .

A few other attendant issues: The Chinese have undervalued their currency since 1994. If the Yuan became the preferred currency for business overnight, investors wold have to know exactly how much value they were getting when they park a portion of their fortunes in Yuan. In addition, Chinese capital markets will have to continue growing to meet what would be an unprecedented demand for Yuan. The Chinese may find that investors want to know a lot more information about their financial products than they are accustomed to releasing. A wealthy investor who is considering buying Chinese corporate bonds may very reasonably expect to know the corporation’s performance over time. If that information is considered a state secret, or if the Chinese economy is still so riddled with subsidies that prices are meaningless, investors will prefer to park their funds in a more open economy. In fact, the Chinese Communist Party may well find that international investors want to know a LOT more about their entire economy than they would like to reveal. Significantly, the Investors Observer article above does not mention these issues.

The brute realities for Americans are unpleasant. When the dollar loses its throne as the world’ s only reserve currency, we can expect that it will significantly lose value. American consumers are leveraged up to their eyebrows. Experian estimates that the average American debt in 2022 was over $95,000. Experian Discusses Consumer Debt As the dollar loses value, debtors will have to work harder to both pay their expenses and this astonishing debt. Americans will be furious to find themselves working harder to reach a financial goal line that will keep moving farther and farther away. Corporations, as well as municipal and state governments will feel the same pain, as will the U.S. federal government.

Economic pain will be intensified by companies having the incentive to transfer production back to the U.S. While it might be satisfying to once again buy mostly American goods, this development will require one of two agonizing changes: The cost of these goods will either have to go WAY UP, to accommodate high U.S. salaries, or wages will have to go WAY DOWN for the same reason. The Investors Observer article quoted an analyst who claimed that U.S. salaries would eventually decline 60%, an astonishing change. For a number of reasons I am not terribly confident in this number, but it is a place to start discussion of the consequences of the dollar’s eventual decline.

In similar manner, if the price of an iPhone jumped from $1000 to $1,600 this would also be a dramatic change. While this latter number is an arbitrary estimate, the point is clear: the only people who have nothing to worry about are oligarchs. Big deal. They’ve never had anything to worry about.

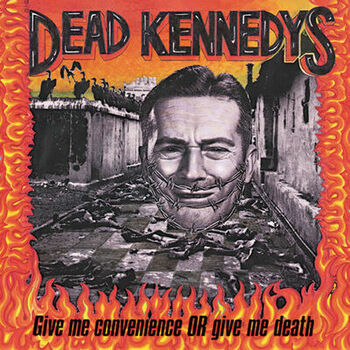

The unsettling reality is this: 1944 was almost eighty years ago. America will never be the single most important country ever again. Over the next fifty years, life will become about as harsh for Americans as it has been for everybody else. As the Dead Kennedys once said, “It’s tough kid, but it’s life.”